defer capital gains taxes without a 1031 exchange

Real estate investors can famously defer capital gains taxes on investment properties with a 1031 exchangeThey sell a property for a profit then roll the proceeds into a. Of course this process comes.

How To Defer Capital Gains Tax With A 1031 Exchange 1031 Crowdfunding

The timing of that tax payment however depends on what happens with the sale proceeds.

. Without the 1031 exchange as vehicle for tax deference the capital gains tax could cop up to 15 to 20 of an investors profit on the sale of an investment property dependent. Thinking about deferring your taxes through 1031 exchanges. Moreover investors can keep 1031 exchanges.

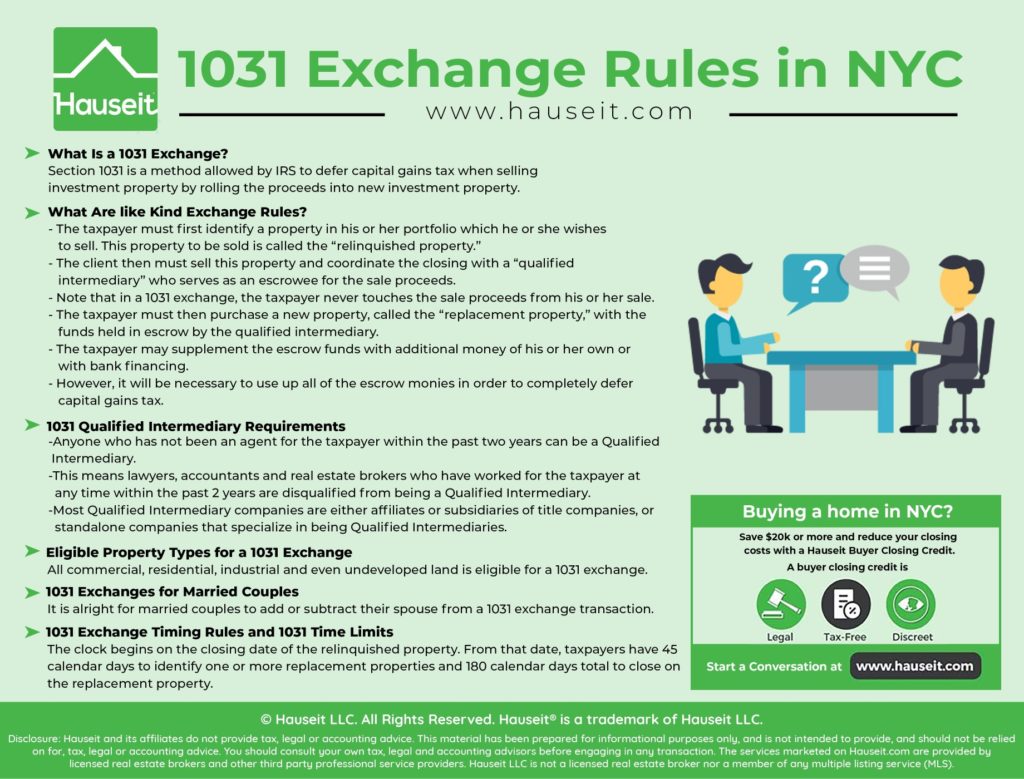

Moreover the DST can be used to defer capital gains taxes on high value assets such as a taxpayers business including goodwill that is typically not applicable to a 1031. Quite often owners of investment properties feel very stuck. If certain very strict parameters are met that owner can defer the 20 tax on the 650000 worth of capital gains on the sale of the Oakland condo until the Santa Fe ranch is sold sometime in.

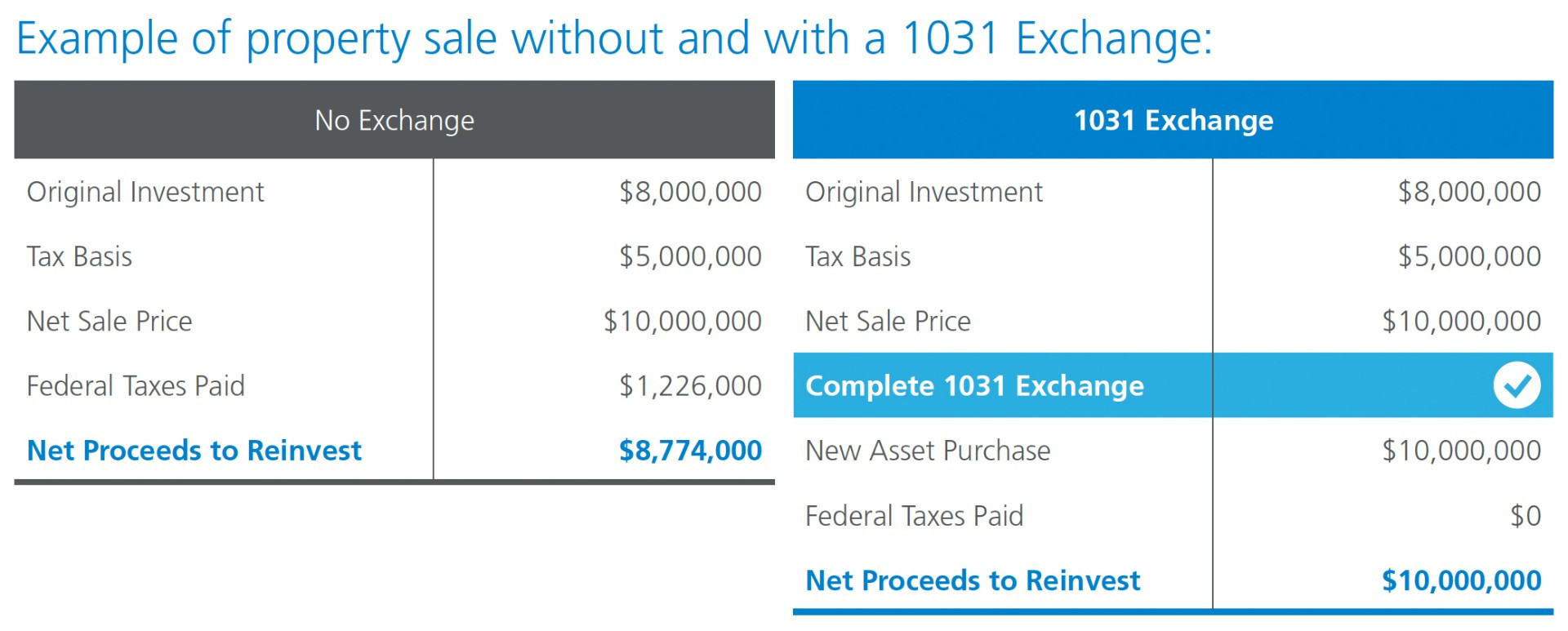

A like-kind exchange allows you to defer not avoid your capital. The 1031 exchange process can be done back-to-back without limit on the number of transactions as long as they are all done correctly. An example of the sale of an appreciated asset with and without a 1031 exchange.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. Its like having an interest free loan from the government. By Margaret Flowers CPA.

A 1031 exchange is a tax break that allows you to basically swap an investment property for another one without paying capital gains taxes. Those taxes could run as high as 15. The new law will allow Qualified Opportunity Zone QOZ investors to reduce their capital gains taxes by up to 15 if they re-invest their realized gains in a Qualified Opportunity.

Coakley Realty trusted since 1989. Bretts company Capital Gains Tax Solutions. A 1031 exchange is a valuable tool for deferring capital gains taxes on investment properties but it is a strategy that requires intimate knowledge of the myriad kinds of taxes.

This means that many people can defer. The main benefit of a 1031 exchange is the deferral of capital gains tax on the sale of investment property. Like a 1031 Exchange the DST can be used to defer capital gains taxes on real estate but unlike a 1031 Exchange it does not require that the taxpayer reinvest in likekind.

The 1031 exchange process can be done back to back without limit on the number of transactions as long as they are all done correctly. Those willing to reinvest and buy more property can defer the capital gains tax with. Tax deferral on the other hand is perfectly legal under the right circumstances such as a 1031 exchange.

They would like to sell their highly appreciated property and use the funds for other options l. Deferred all of his capital gains tax which would have been 580000. Since long-term capital gains taxes typically run 15 to 20 this can add up to a sizable sum that can be invested elsewhere.

This means that many people can defer. Get your questions answered here. A 1031 like-kind exchange allows you to defer paying capital gains taxes if you reinvest the proceeds from the sale of a property into another similar property.

A 1031 Exchange is defined under section 1031 of the IRS code as a strategy that allows investors to defer paying capital gains taxes on any investment property.

Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties

3 Tips For Deferring Taxes With A 1031 Exchange Infographic Cpec 1031 Exchanges In Minneapolis Mn

Never Pay Taxes Again With The 1031 Exchange

How To Do A 1031 Exchange In Nyc Hauseit New York City

How Does A 1031 Exchange Work With Rental Properties

Flock Homes Can You Defer Capital Gains Taxes Without A 1031 Exchange Into A New Property

How To Use A 1031 To Defer Capital Gains Tax Blue Chip Partners

How To Defer Capital Gains Without Doing A 1031 Exchange Youtube

Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home

Defer Capital Gains Taxes Without 1031 Exchange

1031 Exchange The Ultimate Guide Jrw Investments

1031 Exchanges Explained The Ultimate Guide Cws Capital

Should You Defer Capital Gains Taxes With A 1031 Exchange Cnet

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Ways To Potentially Defer Capital Gains Tax On Stocks

How To Defer Capital Gains Tax With A 1031 Exchange 1031 Crowdfunding

Should You Defer Capital Gains Taxes With A 1031 Exchange Cnet